Chase CD, or Chase Certificates of Deposit, are a popular savings option for individuals looking to earn higher interest on their deposits while minimizing risk. These financial instruments are a type of time deposit offered by Chase Bank, allowing customers to lock in their funds for a specified term in exchange for a competitive interest rate. In today's financial landscape, understanding how Chase CDs work, their benefits, and the various options available can help you make informed decisions about your savings strategy.

This guide will delve into the intricacies of Chase CDs, exploring their features, terms, and the advantages they offer over traditional savings accounts. We'll also discuss important considerations, such as early withdrawal penalties and how to select the right CD for your financial goals. Whether you're a seasoned investor or a newcomer to the world of savings, this article will provide valuable insights into Chase CD products.

By the end of this article, you'll have a thorough understanding of Chase CDs and how they can fit into your overall financial plan. So, let's dive into the details and discover everything you need to know about Chase Certificates of Deposit.

Table of Contents

- What is a Chase CD?

- Benefits of Chase CD

- Types of Chase CD

- How to Open a Chase CD

- Interest Rates and Terms

- Early Withdrawal Penalties

- Chase CD vs Other Savings Options

- Conclusion

What is a Chase CD?

A Chase CD, or Chase Certificate of Deposit, is a type of savings account that offers a fixed interest rate for a specified term. The primary characteristic that sets CDs apart from regular savings accounts is that funds must remain deposited for the entire term to earn the stated interest rate. Chase CDs are an attractive option for individuals seeking a safe way to grow their savings without the risk associated with stock market investments.

When you open a Chase CD, you agree to deposit a certain amount of money for a predetermined period, typically ranging from a few months to several years. In return, Chase offers a higher interest rate compared to standard savings accounts. This arrangement makes Chase CDs a suitable choice for those who do not need immediate access to their funds and are willing to commit to a specific savings timeline.

Benefits of Chase CD

Chase Certificates of Deposit come with several benefits that make them a popular choice among savers:

- Higher Interest Rates: Chase CDs typically offer higher interest rates than traditional savings accounts, providing a better return on your investment.

- Fixed Returns: The interest rate is locked in for the entire term of the CD, ensuring predictable returns regardless of market fluctuations.

- Safety: CDs are considered low-risk investments, as they are insured by the FDIC up to $250,000 per depositor, per bank.

- Variety of Terms: Chase offers a range of CD terms, allowing you to choose one that aligns with your financial goals.

- Easy to Manage: Opening and managing a Chase CD is straightforward, with online banking options available for convenience.

Types of Chase CD

Chase offers several types of CDs, each catering to different savings goals and preferences:

1. Standard CD

Standard CDs have fixed interest rates and terms ranging from 1 month to 10 years. These are the most common type of CDs offered by Chase.

2. CD with a Bump-up Option

This type of CD allows you to "bump up" your interest rate once during the term if Chase's rates increase. This feature can be beneficial in a rising interest rate environment.

3. No-Penalty CD

A No-Penalty CD allows you to withdraw your money before the maturity date without incurring an early withdrawal penalty. However, these CDs generally offer lower interest rates compared to standard CDs.

How to Open a Chase CD

Opening a Chase CD is a simple process that can be completed online or in-person at a Chase branch. Here's a step-by-step guide:

- Visit the Chase Website: Go to the official Chase website to explore available CD options and interest rates.

- Select Your CD: Choose the type of CD and term that aligns with your financial goals.

- Complete the Application: Fill out the application form, providing your personal information and funding details.

- Fund Your CD: Transfer the required minimum deposit amount from your Chase checking or savings account or via external transfer.

- Review and Confirm: Review the terms of your CD, including the interest rate, maturity date, and any applicable fees before confirming your application.

Interest Rates and Terms

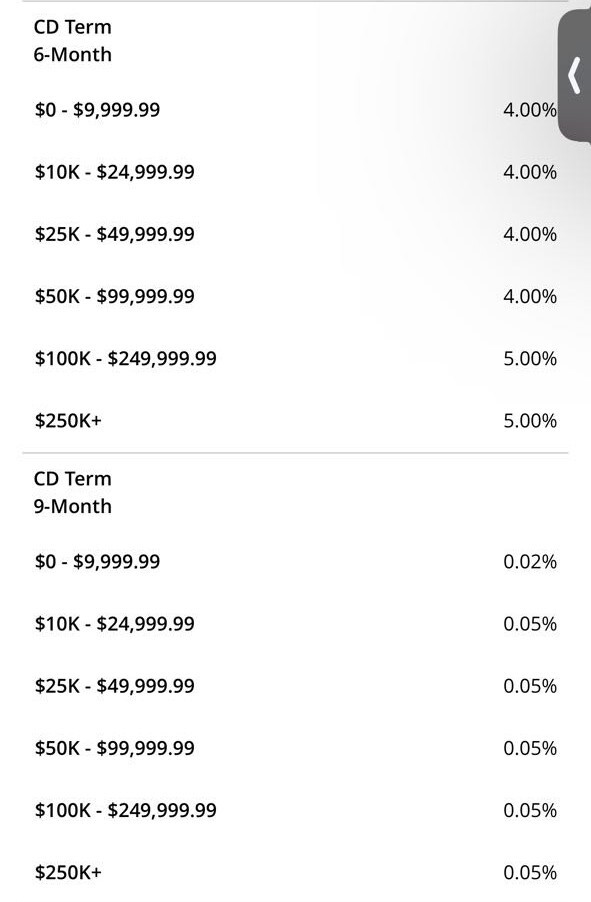

Chase offers competitive interest rates on its CDs, which can vary based on the term length and the type of CD you select. Typically, longer-term CDs provide higher interest rates compared to shorter-term options. It’s important to shop around and compare rates, as they can change frequently. Below is a general overview of the interest rates you might expect:

- 1-Month CD: Generally lower rates

- 6-Month CD: Moderate rates

- 12-Month CD: Competitive rates

- 24-Month and Longer CDs: Higher rates for long-term commitments

Keep in mind that interest rates can also be influenced by market conditions, so it is advisable to check the latest rates directly on the Chase website or by contacting a Chase representative.

Early Withdrawal Penalties

One of the key considerations when investing in a Chase CD is the early withdrawal penalty. If you withdraw your funds before the maturity date, you may incur a penalty that could reduce your earnings. The penalty amount typically depends on the term of the CD and may be calculated as follows:

- For CDs with terms of less than 12 months: Penalty may be equal to 90 days’ interest.

- For CDs with terms of 12 months or longer: Penalty may be equal to 180 days’ interest.

It’s crucial to review the penalty terms before opening a CD, especially if you anticipate needing access to your funds before the maturity date.

Chase CD vs Other Savings Options

When comparing Chase CDs to other savings options, such as traditional savings accounts or high-yield savings accounts, it's important to consider the following factors:

1. Interest Rates

Chase CDs typically offer higher interest rates compared to traditional savings accounts, making them a better choice for long-term savers.

2. Liquidity

Traditional savings accounts allow for easy access to funds, while CDs require you to lock in your money for a set period. If you need immediate access, a savings account may be more suitable.

3. Risk

Both Chase CDs and savings accounts are low-risk options, but CDs provide a guaranteed return if held to maturity, while savings accounts may offer variable interest rates.

Chase CDs are an excellent choice for those looking to earn a higher return on their savings without taking on significant risk. However, individuals should weigh their need for liquidity against the benefits of locking in a fixed rate.

Conclusion

In summary, Chase CDs offer a reliable way to grow your savings with higher interest rates and low risk. They provide a range of terms and options to cater to different financial goals, making them a suitable choice for both conservative and strategic savers. Remember to consider the early withdrawal penalties and choose the CD that best aligns with your financial situation.

If you're interested in exploring Chase CD options further, consider visiting a Chase branch or their website for more information. Feel free to leave a comment below or share this article with others who might benefit from learning about Chase Certificates of Deposit!